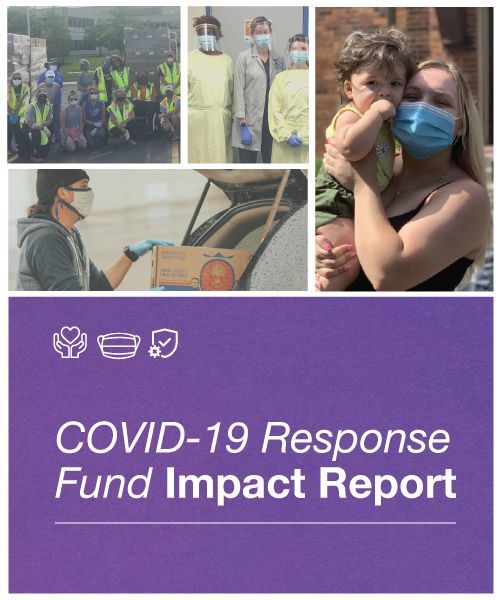

COVID-19 Response

Dave McGowan, DuPage Foundation president & CEO, delivers a final report on the COVID-19 Response Fund, which raised and granted nearly $1.8 million since its inception on March 19, 2020.

DuPage Foundation COVID-19 Response Fund

We created the COVID-19 Response Fund for DuPage County to receive contributions from those looking to give locally during a time of crisis as part of a powerful, coordinated response. Our thanks to our lead partners including the Birck Family, the Hyett Family, the Illinois COVID-19 Response Fund, two area private foundations wishing to remain anonymous, Doris K. Christopher and Family, the Shebik Family, and grants from the Gustafson Family Foundation and Snodgrass Family funds of DuPage Foundation, along with scores of contributions from other individuals such as Dr. Chand featured in our video, businesses, and foundations, which brought the Fund’s total to nearly $1.8 million.

Direct gifts to your favorite charities are still needed and are strongly encouraged. While the COVID-19 Response Fund is now closed, we invite individuals, businesses and foundations to give to our Emergency Fund to help us respond effectively to our local not-for-profits that are being impacted by and charged with responding to the repercussions of emergencies on the front line.